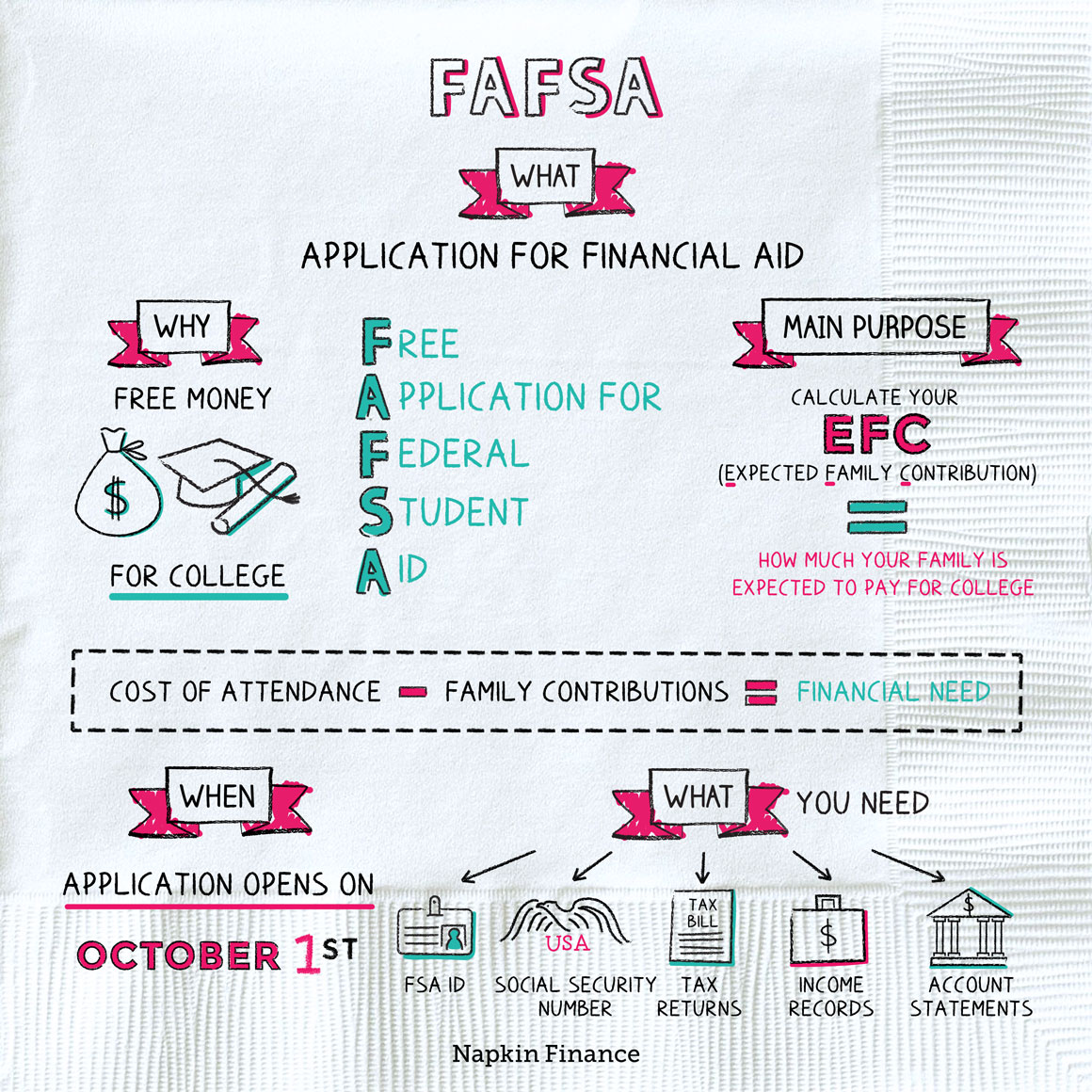

What is FAFSA? FAFSA stands for Free Application for Federal Student Aid, and it is available to all eligible students to apply for free financial aid. Filling out FAFSA can help students pay for college, and can even help them secure their financial future. In this article, we’ll discuss what FAFSA is, how to fill it out correctly, and what other factors you should consider. To get started, we’ve outlined the three main forms of FAFSA.

Filling out the FAFSA

Before you fill out the FAFSA, you should have your Social Security Number and other identifying information ready. You must also have your driver’s license number or alien registration number if you are not a US citizen. You should include your legal name on the FAFSA, since your tax returns must match your legal name. Also provide proof of any untaxed income, such as workers’ compensation, child support, or veteran’s benefits.

It is estimated that filling out the FAFSA will take you about one hour, including gathering the required information, reviewing it, and reviewing it. Generally, the earlier you fill out the FAFSA, the better, as the pool of available federal monetary aid is limited. Besides, you may find that the process of renewal is quicker. Nevertheless, you should be patient and follow all instructions carefully. If you are facing any problem while filling out the FAFSA, don’t be discouraged.

Calculating your expected family contribution

The Expected Family Contribution (EFC) is an important factor in determining how much financial aid a student can receive. This figure is based on a formula established by federal law, and it represents how much a family can realistically contribute toward the cost of college. A family’s EFC will be in the form of a dollar amount, so 12000 equals $12,000, for example.

The EFC is calculated by using the information on the FAFSA for both the parents and the dependent student. The EFC for an independent student with dependents is almost identical to the formula for a family with dependent students. The calculation process is straightforward and uses three basic steps: calculating the available income of the student and determining the contribution from their assets. After that, the number of dependents is added to the student’s EFC.

Need-based financial aid programs

Need-based financial aid is awarded to students who are unable to pay the full cost of college out-of-pocket. It is determined through the Free Application for Federal Student Aid, which analyzes the financial contribution of the student and family. Students who demonstrate a high need for assistance increase their chances of receiving financial aid. Applicants must submit the FAFSA as early as possible to qualify for need-based aid.

Federal need-based financial aid is divided into two types: subsidized loans and unsubsidized loans. Subsidized loans are paid to the student while in school, and unsubsidized loans must be repaid when the student graduates. Scholarships, work-study positions, and federal grants are given based on the financial need of students. There are two types of need-based financial aid programs: merit-based and need-based.

Other factors to consider

You can use the IRS Data Retrieval Tool to enter relevant figures automatically on the FAFSA. As a student, your financial situation should be clear and detailed. Also consider what you plan to study in college and how many years you plan to attend. If you’re a single parent, you must list yourself as a dependent. Also, consider if you plan to study abroad or in your state. Some financial aid may be given to students based on their COA.

You should report the amounts from your foreign tax returns on the FAFSA. This will prevent you from having to use estimates on the form. However, make sure that you use data from your U.S. return when you fill out the FAFSA. In addition to reporting income, you should also disclose any child support payments or federal program benefits. The income and expense information you enter on the FAFSA should be accurate as of the application date.